Staking generates passive rewards and is an ideal choice for long-term crypto investors, motivating enthusiasts to search for the best crypto staking platforms to earn healthy APYs. Staking is one of the best ways to earn passive income in crypto. Whether you choose one of the many custodial staking platforms or opt for DeFi staking instead, it’s a great way to earn yield on your crypto assets.

This guide will review the 12 best crypto staking platforms from leading providers for supported coins, average APYs, withdrawal terms, security, and accessibility. Most importantly, the guide will directly answer the question: “Where can I stake crypto?”

We’ll also explain how crypto staking works, the benefits and risks, and how to get started in under 10 minutes.

The Best Crypto Staking Platforms to Use Right Now

Listed below are the 12 best DeFi staking platforms for 2025:

- Best Wallet – Best for in-wallet self-custodial staking

- Uphold – Industry-leading staking APYs across various cryptocurrencies

- eToro – Popular choice for both beginner and advanced investors

- MEXC – A great option for staking stablecoins, USDT pays up to 8.8%

- Kraken – Leading crypto exchange with flexible staking options and high yields

- OKX – Offers a decentralized staking aggregator that connects to hundreds of pools

- Margex – The overall best crypto staking site, allows staked coins to be used for trading capital

- Binance – Popular staking platform offering enhanced yields on longer lock-up periods

- ByBit – Off-chain staking rewards with flexible and locked plans

- Nexo – Excellent interest rates of up to 12% APY on crypto holdings

- Kucoin – Earn staking APYs of up to 24% with bi-weekly distributions

- Bitrue – Best for its top variety of staking options

Reviewing the Top Cryptocurrency Staking Platforms

We will now review the best staking crypto platforms listed above. Read on to learn about the staking site offering the highest staking rewards on crypto assets and select the site that suits you best.

1. Best Wallet – Best For Self-Custodial Staking

Best Wallet takes our #1 pick for the best platform for on-chain, self-custodial staking. The user interface is easy to navigate and here at 99Bitcoins, we preach the importance of self-custody, so Best Wallet checks all the boxes.

Not only is Best Wallet beginner-friendly, but also has advanced features and functions for pros who have been around the blockchain a time or two. On-chain staking is one of the best passive ways to earn APY on some of the most popular Proof-of-Stake cryptocurrencies and Best Wallet users can stake multiple assets without having to undergo KYC. This wallet supports over 50 blockchains such as Bitcoin, Ethereum, Solana, and more, allowing for staking on multiple networks without needing to switch wallets.

To begin staking, all users need to do is buy or transfer the token they wish to stake and follow the steps in the app. We like that the app makes staking requirements clear and lets the user know how long the tokens will be staked for, any unbonding periods, and expected rewards.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Best Wallet | Up to 4,000% APY | 7.81% | Staking is done on-chain and APYs are determined by network rewards which fluctuate. The Best Wallet staking aggregator aggregates multiple DeFi platforms so users can find the most favourable terms and returns for them. Token lockup and unbonding periods are subject to the blockchain network and not determined by Best Wallet. Users should DYOR to understand how staking works on different blockchain networks. |

Best Wallet Key Features

- Non-custodial security ensures users retain control over their funds.

- Integrated DEX enables trading without relying on third-party exchanges.

- Staking aggregator offers passive income opportunities.

- Fiat on-ramp/off-ramp helps users convert fiat to crypto and vice versa.

- Supports 1000+ cryptocurrencies across multiple chains.

Best Wallet Pros

- Users can buy, sell, and swap cryptocurrencies from directly within the wallet

- Supports over 50 blockchains and thousands of assets

- Staking interface is user-friendly and easy to understand

- Allows staking through various DeFi platforms like Aave and Lido for diverse rewards and higher staking APY options

- Tracks all assets in one place for easy management

- Best Wallet is self-custodial, improving security and removing third-party risks that typically come with staking platforms

Cons

- Users should be familiar with DeFi before getting involved

2. Uphold – Popular Staking Platform With Industry-Leading APYs

Uphold is an excellent platform for crypto staking, offering users a simple and rewarding way to earn passive income from digital assets. With its intuitive interface and diverse range of supported cryptocurrencies, Uphold allows its users to maximize the value of their holdings.

One of the most appealing aspects of Uphold’s staking service is the variety of supported tokens. Users can stake popular cryptocurrencies such as Ethereum, Solana, Polkadot, and more, giving them flexibility in choosing assets that align with their investment strategies.

By participating in staking, users earn rewards based on the network’s performance and their contribution, with competitive rates that allow for significant returns over time. For example, staking Injective earns 14% APY, while competitor platforms offer up to 11% APY on this asset. Thats a lot of passive income on your crypto.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Uphold | N/A | N/A | Staking is done via the Uphold mobile app on iOS or Android. There are multiple assets to stake, except for Bitcoin and stablecoins. Uphold offers competitive yields on its secure platform, and it allows participation in DeFi and staking on third-party platforms via its own non-custodial wallet. |

Uphold Key Features

- Non-custodial wallet for DeFi staking via third-party providers.

- Integrated DEX for multi-chain asset swapping.

- Staking yields across various assets.

- Fiat on-ramp helps users convert fiat to crypto.

- Staking rewards are distributed weekly.

Uphold Pros

- Users can buy, sell, and swap cryptocurrencies from within the app

- Supports over 300 cryptocurrencies across varios blockchains

- Staking interface is user-friendly and easy to understand

- Allows staking through various DeFi platforms

- Tracks all assets in one place for easy management

- Staking yields are distributed weekly

Cons

- Uphold doesn’t offer stablecoin or Bitcoin staking

3. eToro – Top Exchange Supports Copy Trading Tool

eToro remains a standout crypto exchange for UK investors and beyond, particularly when it comes to staking crypto assets. Known for its robust security measures, eToro ensures that your investments are well-protected. The crypto exchange implements two-factor authentication (2FA) and stores assets in cold wallets, adding an extra layer of security. Additionally, client funds are held in segregated bank accounts, giving you peace of mind.

eToro is also incredibly user-friendly, making it an excellent choice for beginners. Setting up an account, depositing funds, and starting your crypto staking journey takes just minutes. With nearly 100 cryptocurrencies supported, including popular options like Bitcoin, Ethereum, Solana, and Cardano, eToro offers great flexibility for diversifying your staking portfolio. However, U.S. customers can only buy Bitcoin, Bitcoin Cash, and Ethereum.

Depending on your location, eToro can be one of the best crypto exchanges for crypto staking and a great way to earn passive income.

One of the platform’s key features is its CopyTrader™ service, allowing you to mirror the strategies of successful crypto traders. This can be particularly beneficial for those new to staking or looking to learn from more experienced investors.

Note: Staking reward is not offered for US, UK/ FCA users.

However, it’s important to note that eToro’s fees are slightly higher than some other platforms. For example, U.S. dollar deposits via wire transfer are free, but there is a 0.5% fee for deposits made with a debit/credit card or PayPal. Additionally, there’s a 1% commission on crypto trades.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| eToro | Up to 2.4% APY | N/A | Staking available on select cryptocurrencies (notably Cardano and Ethereum); staking rewards are automatically earned with no lock-up periods, and eToro handles the technical aspects, making it easy for users. |

eToro Key Features:

- Diverse Range of Supported Cryptos: With 99 different coins available for trading and staking, eToro offers one of the broadest selections in the market. This variety allows you to choose the best assets for staking based on your investment goals. U.S. users, however, can only buy Bitcoin, Bitcoin Cash, and Ethereum.

- Regulation and Security: eToro operates under stringent regulatory oversight, ensuring that your funds are secure. The platform is regulated by top-tier financial authorities, which adds an extra layer of trust and safety for your staking activities.

- User-Friendly Interface: eToro’s platform is designed with the user in mind. Whether you’re accessing it via the web or mobile app, you’ll find it easy to navigate, even if you’re new to crypto staking.

- Educational Resources: If you’re new to staking, eToro offers a wealth of educational resources, including guides, webinars, and market analysis. These tools are invaluable for making informed decisions and maximizing your staking returns.

- Low Minimum Investment: You can start staking with as little as $10 (around £8), making eToro accessible to a wide range of investors, from beginners to those with more substantial portfolios.

Pros

- Excellent for beginners with a user-friendly platform

- Supports 99 different cryptocurrencies but only BTC, BCH, and ETH for U.S. customers

- Low minimum staking requirement of $10

- Copy experienced crypto traders’ staking strategies

- Secure wallet storage with 2FA protection

Cons

- Higher fees, with a 0.5% charge on USD deposits made via debit/credit card or PayPal

- 1% commission on crypto trading

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. 99Bitcoins is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

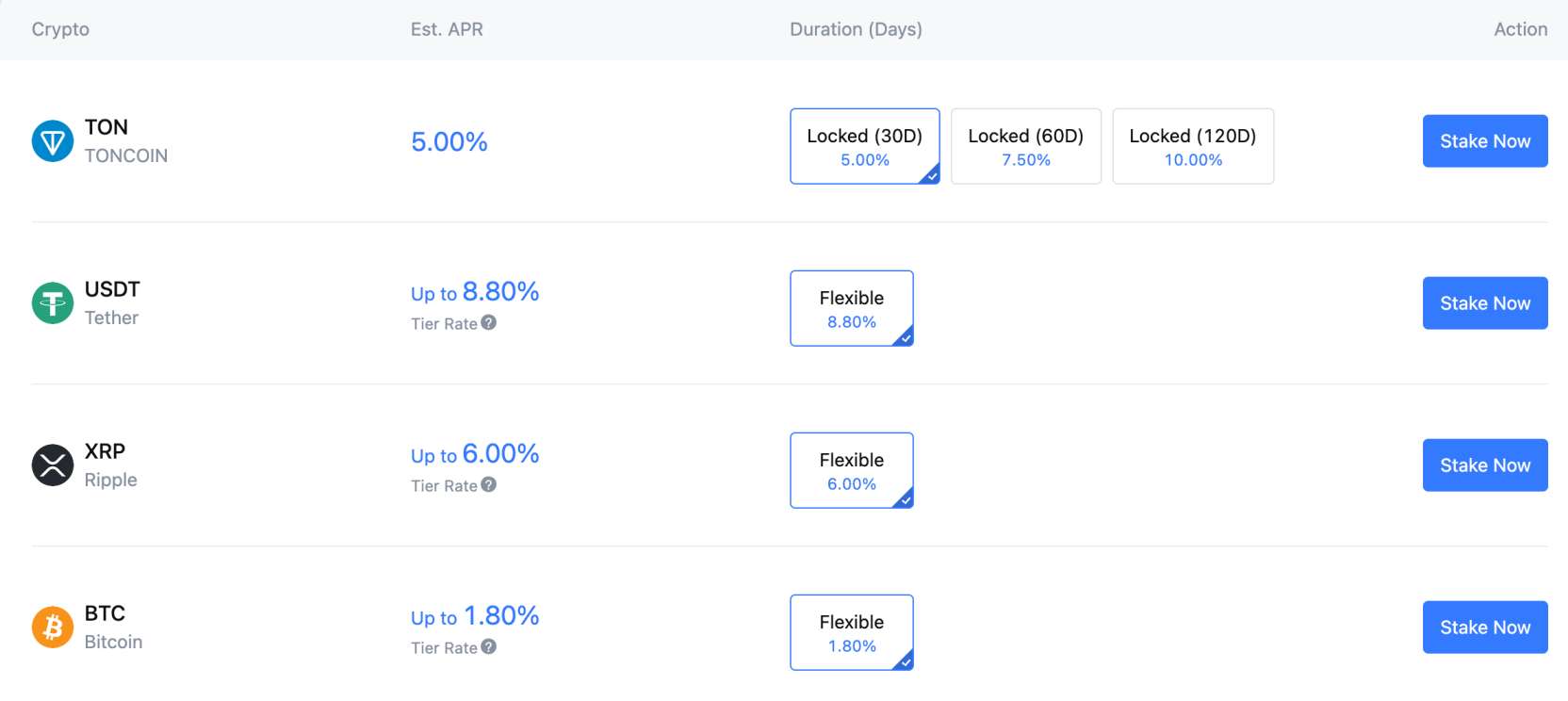

4. MEXC – A Great Option for Staking Stablecoins, USDT Pays up to 8.8%

MEXC is the best crypto staking platform for stablecoins. You’ll earn much higher yields than other platforms; USDT generates APYs of up to 8.8%. What’s more, USDT staking plans are flexible. This means you can withdraw the USDT tokens at any time. However, do note that MEXC has a tiered system on USDT plans.

Only the first 300 USDT earns 8.8%. Anything between 300 and 1,000 USDT earns 1.5%. Deposits above 1,000 USDT earn just 0.8%. MEXC also offers high APYs on standard cryptocurrencies. For example, you’ll get up to 10% on Toncoin and 6% on XRP. Ethereum is also competitive at 4.8%. However, Bitcoin yields just 1.8%.

MEXC distributes staking rewards daily, which is another plus point. When you’re not staking coins, MEXC is also a great option for trading. It offers over 2,000 cryptocurrencies, including some of the best altcoins. It supports spot trading and leveraged futures of up to 200x. MEXC commissions are some of the lowest in the market.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| MEXC | 1.8% | 8.8% | Most coins come without lock-up terms. Rewards are paid daily. |

MEXC Key Features:

- Wide Range of Supported Cryptos: MEXC supports over 1,100 cryptocurrencies, offering a broad selection for trading and investment, which is ideal for investors looking to explore a wide array of assets.

- Spot and Futures Trading: MEXC provides robust trading features, including spot trading, futures trading, and margin trading, catering to both beginners and advanced users.

- MEXC Earn: MEXC’s Earn platform allows users to stake various cryptocurrencies and earn competitive interest rates, with flexible and fixed-term options available to suit different investment strategies.

- Global Accessibility: MEXC is available in over 170 countries, making it a highly accessible platform for traders and investors around the world.

Pros

- Earn up to 8.8% when staking USDT

- Withdraw coins at any time without penalties

- Receive staking payments daily

- One of the largest crypto exchanges globally

- Offers rock-bottom trading commissions

Cons

- Only the first 300 USDT earns the top-tier rate

- USDC yields just 0.85%

5. Kraken – Leading Crypto Exchange With Flexible Staking Options and High Yields

Kraken is next on our list of the best crypto staking platforms, offering an impressive combination of high yields and institutional-grade security. Kraken currently has both bonded and flexible staking options for some of the most popular cryptos.

The platform stands out for its user-friendly approach to staking, so beginners can get started without any technical knowledge. Users can begin earning rewards on their staked assets with just a few clicks, and receive payouts twice a week.

For those looking for higher yields, Kraken’s bonded staking options offer suitable returns. Depending on the asset, lockup periods range from 3 to 28 days. The platform clearly outlines each staking option’s requirements, including expected rewards, unbinding periods, and any associated terms.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

|---|---|---|---|

| Kraken | 0.15% | 6.5% | Both flexible and bonded staking are available. Rewards are distributed twice a week. Some geographic restrictions apply, as staking is unavailable in some regions including the US. |

Kraken Key Features:

- High Security: Kraken implements powerful security protocols, with 95% of assets stored in air-gapped cold storage vaults. Features include 24/7 armed guards, video surveillance, and full-reserves backing of all staked assets.

- Flexible Staking Options: You can instantly unstake in the flexible option with no penalties, which will generally offer lower but still competitive APY rates. Kraken also has higher-yield options with lockup periods ranging from 3-28 days, providing APY rates of up to 24% for certain cryptos.

- Comprehensive Support: Access to over 20 proof-of-stake assets, including popular cryptos like Ethereum (2.5-7% APY with 8-day bonding) and Polkadot (12-18% APY with 28-day bonding).

- Automated Reward Distribution: Twice-weekly automated payouts ensure regular passive income generation. Rewards are automatically compounded for optimal returns if you’ve selected the reinvesting option.

- High-End Architecture: Kraken offers multi-signature technology for all transactions, regular security audits by third-party firms, a dedicated institutional support team, and custom reporting and analytics.

Pros

- Competitive yields reaching up to 24% APY on certain assets

- No technical knowledge required—stake with just a few clicks

- Flexible staking option allows instant unstaking without penalties

- Strong track record of security

- Regular bi-weekly reward distributions

Cons

- Staking service not available in the US

- Some assets require longer bonding periods for maximum yields

6. OKX – Comprehensive Crypto Staking and Trading Platform

OKX is one of the best staking platforms out there and should certainly be in your consideration for where to stake your crypto assets. While OKX is a popular centralized exchange, it also offers a decentralized ecosystem. It comes in-built with a bridge aggregator. In simple terms, this means OKX obtains staking yields from hundreds of external pools. Each pool operates a decentralized framework, meaning staking transactions are backed by smart contracts.

There is no requirement to leave the OKX platform. Simply search for your preferred staking coin and review the best pools. Once you’ve connected a wallet to OKX, you can begin staking straightaway. To offer some insight into yields, USDT offers a maximum APY of 38.37%. Some pools have limited liquidity though, so are less reputable than other providers.

Another of the things that’s worth checking out is OKX’s Dual Investment product, which offers higher potential returns by allowing users to invest in two assets at the same time. This is great news for more experienced traders looking to maximize their profits through strategic investments. You can also find a Spot and Derivatives market, catering to advanced traders who want to engage in futures, options, and margin trading.

OKX Key Features:

- Wide Range of Supported Cryptos: OKX supports over 300 cryptocurrencies, offering a broad selection for trading and staking, which is ideal for investors looking to diversify their portfolios.

- Flexible Staking and Savings Options: The OKX Earn feature provides flexible staking options, allowing users to choose between different lock-up periods to maximize their returns while maintaining control over their assets.

- Advanced Trading Features: OKX offers a comprehensive suite of trading tools, including spot, futures, and margin trading, as well as a Dual Investment product for higher returns, catering to both beginners and advanced traders.

- Strong Security Measures: OKX employs top-tier security protocols, including multi-factor authentication, cold storage, and real-time asset monitoring, ensuring the safety of user funds.

- User-Friendly Platform: Despite its advanced features, OKX maintains a user-friendly interface that makes it accessible to both novice and experienced crypto traders.

Pros

- Supports over 300 cryptocurrencies for trading and staking

- Flexible staking options with competitive APYs

- Advanced trading tools including futures, options, and Dual Investment

- Strong security measures, including cold storage and real-time monitoring

- User-friendly platform with a clean, intuitive interface

Cons

- Staking rewards and availability can vary depending on market conditions

- Some advanced features may have a steep learning curve for beginners

- Limited availability of customer support in some regions

7. Margex – The Overall Best Crypto Staking Site for 2025

Margex is considered one of the best crypto leverage trading platforms and it has the best app for staking crypto. The platform offers competitive staking yields for long-term holders. A very good example of this is the 3% APYs you get on Bitcoin, with 4.7% on Ethereum. Chainlink is also competitive, at 3%.

If you’re looking to generate passive rewards without volatility, Margex offers 5% on USDT and USDC. Here’s the standout feature; Margex enables you to trade while coins are being staked. This offers much-needed liquidity, rather than the coins being locked. Best of all, staking yields are credited daily. The funds can be reinvested, allowing you to compound the returns.

In terms of trading, Margex specializes in perpetual futures. These derivative products allow you to trade with leverage of up to 100x. All markets support long and short trading. Commissions at Margex cost just 0.06%. Traders have access to plenty of analysis tools, including indicators and charts. There are no KYC requirements when joining Margex. If you want to learn more about this highly-rated exchange, we go into more detail in our dedicated Margex Review.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Margex | 3% | 5% | No lock-up terms. Staked coins can be traded. Rewards are paid daily. |

Margex Key Features:

- No KYC Required: Margex allows users to trade without mandatory KYC (Know Your Customer) verification, offering a higher level of privacy for those who value their anonymity in the crypto space.

- Customizable Leverage: Traders can choose their leverage level on Margex, from 5x to 100x, providing flexibility to align with their risk tolerance and trading strategy.

- Proprietary MP Shield™ System: Margex’s unique MP Shield™ system is designed to prevent price manipulation by aggregating liquidity from multiple providers and filtering out suspicious trading activities, ensuring a fair trading environment.

- Competitive Fees: Margex offers competitive trading fees, with transparent pricing and no hidden costs. This makes it an attractive option for both casual and high-volume traders.

Pros

- The overall best crypto staking platform in 2025

- Offers APYs of up to 5%

- No lock-up terms

- Staked coins can be used to trade

- Rewards are distributed daily

- Also one of the best no KYC crypto exchanges

Cons

- Currently supports just five staking coins

- Doesn’t support spot trading markets

8. Binance – Popular Staking Platform Offering Enhanced Yields on Longer Lock-Up Periods

Binance is best known for its low-cost, high-volume trading platform. The exchange offers some of the best crypto staking rewards – especially for long-term investors. This is because Binance offers enhanced staking yields when the coins are locked for longer periods. For instance, you’ll earn Solana APYs of just 0.9% on flexible plans.

However, this increases to 8.9% when opting for a 120-day lock-up period. Similarly, Sui yields start from just 1.41% on flexible plans. In contrast, locking the coins for 120 days increases the yield to 9.6%. Binance also offers competitive staking rewards on stablecoins. USDT and USDC pay over 10% and 8%, respectively.

If you’re an American trader, Binance has a separate U.S. platform. This comes with different yields and there’s no support for stablecoins. That said, you can earn up to 10.8% on Kusama, and 12.2% on Polkadot. Ultimately, the Binance staking platform is the best option if you’re looking to combine competitive staking rewards with a top-rated trading platform.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Binance | 0.32% | 10.02% | Most staking coins come with multiple lock-up options, ranging from flexible to 120 days. Reward distributions depend on the pool. |

Binance Key Features:

- Extensive Cryptocurrency Support: Binance offers one of the largest selections of cryptocurrencies, with over 350 assets available for trading, making it a go-to platform for those looking to diversify their portfolios.

- Advanced Trading Tools: Binance provides a comprehensive suite of trading tools, including spot, margin, futures, and options trading, catering to both beginners and advanced traders.

- Binance Earn: Users can earn passive income through a variety of staking options, savings accounts, and liquidity pools with flexible and fixed-term options offering competitive APYs.

- Binance Smart Chain (BSC): A fast and low-cost blockchain that supports decentralized finance (DeFi) projects, NFT markets, and more, giving users access to a wide range of decentralized applications.

Pros

- Earn high APYs when locking up coins for longer periods

- USDT deposits pay 10.02% on a 120-day term

- Supports a wide range of altcoins

- Offers a staking rewards calculator

- Also one of the best exchanges for spot trading

Cons

- The maximum Bitcoin APY is 0.32%

- Flexible plans often come with low yields

9. ByBit – Earn Staking APYs of 4.5 and 10% on Bitcoin and Selected Stablecoins

ByBit offers a wide range of trading and staking options with a commitment to security and user experience. On this platform you can find the much-touted Flexible Staking program, which allows users to earn interest on their crypto assets without committing to long-term lock-ups. This feature is particularly appealing to users who want to maintain liquidity while earning rewards.

Bybit is another staking platform where you can find both flexible staking and DeFi Mining. With this second feature, users can participate in decentralized finance (DeFi) projects to earn higher returns through liquidity provision. This makes Bybit an attractive platform for those interested in maximizing their earnings through a combination of trading, staking, and DeFi participation.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| ByBit | Up to 4.5% APY | Up to 10% APY | Flexible staking with no lock-up periods for easy withdrawal; DeFi Mining offers higher returns with varying terms depending on the project. |

ByBit Key Features:

- Flexible Staking Options: Bybit’s flexible staking program offers competitive APYs on a variety of cryptocurrencies, allowing users to earn rewards while keeping their assets liquid.

- Advanced Trading Features: Bybit provides a comprehensive suite of trading tools, including spot trading, derivatives, and margin trading, catering to both beginners and experienced traders.

- DeFi Mining Opportunities: Bybit’s DeFi Mining feature enables users to participate in DeFi projects, offering the potential for higher returns through liquidity provision and staking.

- Robust Security Measures: Bybit employs top-notch security protocols, including multi-signature wallets, 2FA, and cold storage, ensuring that user funds are protected against potential threats.

Pros

- Flexible staking with competitive APYs

- Advanced trading tools including spot, derivatives, and margin trading

- DeFi Mining for higher potential returns

- Strong security protocols, including cold storage and multi-signature wallets

- User-friendly platform with a clean interface

Cons

- Staking rewards may vary based on market conditions

- Some advanced features may be challenging for beginners

- Limited customer support during high-traffic periods

10. Nexo – Competitive Interest Rates and Great Range of Cryptocurrencies

Nexo has earned its reputation as a trusted platform for crypto enthusiasts interested in trading and staking their digital assets. The trading platform is easy to use and is a best exchange for staking. Nexo supports over 60 cryptocurrencies, including popular options like Bitcoin, Ethereum, and Polkadot, providing ample opportunities for portfolio diversification.

One of Nexo’s standout features is its Earn Interest program, which allows users to earn up to 12% APR on their crypto holdings. This can be particularly attractive for those looking to maximize their returns through staking. Nexo also offers instant crypto credit lines, enabling users to borrow against their crypto assets without selling them.

Security is a top priority at Nexo, with the platform utilizing military-grade 256-bit encryption, two-factor authentication (2FA), and insurance on custodial assets up to $775 million, ensuring your investments are safe and secure.

| Staking Site | Top Bitcoin APY | Top Stablecoin APY | Staking Terms |

| Nexo | Up to 7% APY | Up to 12% APY | Flexible staking terms with no lock-up periods for flexible staking; higher APY available when opting for fixed-term staking or holding NEXO tokens. |

Nexo Key Features:

- High-Interest Earnings: Nexo offers competitive interest rates on a variety of cryptocurrencies, making it an attractive option for those looking to earn passive income through staking.

- Robust Security Measures: Nexo prioritizes the security of your assets, offering insurance on custodial holdings and employing top-tier encryption technologies to protect your funds.

- User-Friendly Interface: Nexo’s platform is designed to be intuitive and easy to navigate, whether you’re accessing it via a web browser or mobile app. This makes it a great choice for both beginners and seasoned investors.

- Wide Range of Supported Cryptos: With support for over 60 cryptocurrencies, Nexo provides a wide array of options for trading and staking, allowing you to diversify your portfolio with ease.

- Instant Crypto Credit Lines: Nexo’s crypto-backed credit lines allow you to borrow against your holdings without the need to sell your assets, providing liquidity while you continue to earn on your investments.

Pros

- Competitive interest rates up to 12% APR on crypto holdings

- Insurance on custodial assets up to $775 million

- Supports over 60 cryptocurrencies for trading and staking

- User-friendly platform with an intuitive interface

- Instant crypto credit lines for borrowing against your assets

Cons

- Interest rates vary depending on the type of cryptocurrency and staking duration

- Some features, like the highest interest rates, require holding NEXO tokens

- Withdrawal fees can apply depending on the chosen cryptocurrency

11. KuCoin – A Versatile Crypto Trading and Staking Platform

Known for its wide range of supported assets, competitive staking rewards, and advanced trading features, KuCoin meet the needs of both novice and seasoned crypto investors. Some in the crypto community consider it as a best exchange to stake crypto. It is also an NFT staking platform, but it only allows few NFTs to be staked.

This staking platform has established itself as a go-to platform for crypto enthusiasts, particularly those interested in trading and staking a diverse range of digital assets. Security is a priority on KuCoin, with features such as industry-standard encryption, multi-factor authentication (MFA), and insurance funds designed to protect user assets against potential breaches.

One of the key strengths of KuCoin is its extensive selection of supported cryptocurrencies, with over 700 assets available for trading and staking. This makes it one of the most versatile platforms in the crypto space, allowing users to diversify their portfolios easily.

KuCoin also offers a Soft Staking program, which allows users to earn rewards on their idle assets without having to lock them up. This flexibility is particularly appealing to those who want to maintain liquidity while still earning a return on their investments. Additionally, KuCoin’s Trading Bot feature helps automate trading strategies, making it easier for users to optimize their trading activities without constant monitoring.

KuCoin Key Features:

- Extensive Asset Selection: KuCoin supports over 700 cryptocurrencies, providing one of the broadest selections in the industry. This allows users to explore a wide range of assets for both trading and staking.

- Flexible Staking Options: KuCoin’s Soft Staking program offers competitive rewards without the need to lock up assets, giving users the flexibility to withdraw or trade their staked assets at any time.

- Advanced Trading Features: KuCoin caters to experienced traders with advanced tools like margin trading, futures, and the Trading Bot, which automates strategies to maximize returns.

- Security and Protection: KuCoin employs multiple layers of security, including encryption, multi-factor authentication, and an insurance fund to safeguard user assets, providing peace of mind for traders and stakers alike.

- User-Friendly Interface: Despite its advanced features, KuCoin maintains a user-friendly interface that is accessible for beginners while offering the depth and functionality needed by more experienced users.

Pros

- Supports over 700 cryptocurrencies for trading and staking

- Soft Staking program with no lock-up periods

- Advanced trading features including margin trading and futures

- Automated Trading Bot for optimized trading strategies

- Strong security measures, including insurance for user assets

Cons

- Staking rewards may vary depending on the asset and market conditions

- Customer support response times can sometimes be slow

- Some features may be complex for beginners without prior trading experience

12. Bitrue – Novel Staking Options Including DeFi Yield Farming

Bitrue is a reliable platform for crypto enthusiasts, offering a solid blend of security, diverse asset offerings, and innovative staking options. It is one of the best platforms for staking crypto. Its Power Piggy program allows users to earn interest on a variety of cryptocurrencies with flexible staking options. This option is particularly popular among users looking to earn passive income without locking up their assets for extended periods.

It also boasts a feature called BTR Lockups, which provide even higher returns for users willing to stake their assets for fixed periods. Additionally, Bitrue’s Yield Farming Hub enables users to participate in decentralized finance (DeFi) yield farming, further enhancing their earning potential through various DeFi projects.

Bitrue Key Features:

- Power Piggy Program: This flexible staking option allows users to earn interest on their crypto holdings without long-term lock-ups, making it an attractive choice for those who want to maintain liquidity.

- BTR Lockups: For users willing to commit to longer staking periods, BTR Lockups offer higher returns, providing a lucrative option for those looking to maximize their earnings.

- Wide Range of Supported Cryptos: Bitrue supports over 200 cryptocurrencies, giving users the ability to trade and stake a diverse array of digital assets.

- Security and Protection: Bitrue employs strong security measures, including 2FA, SSL encryption, and cold storage, ensuring that user funds are well-protected against potential threats.

Pros

- Flexible staking options with the Power Piggy program

- Higher returns available through BTR Lockups

- Supports over 200 cryptocurrencies for trading and staking

- Strong security measures including cold storage and 2FA

- User-friendly interface with innovative features like yield farming

Cons

- Staking rewards can fluctuate depending on market conditions

- Higher returns on BTR Lockups require longer commitment periods

- Customer support may not always be responsive during peak times

The Basics of Staking Crypto

In simple terms, staking in crypto is a passive investing tool. It enables crypto investors to generate a yield on their holdings. This means investors can increase the number of coins they own. This is similar to depositing cash in a savings account. However, not all cryptocurrencies can be staked. On the contrary, staking coins must operate on the proof-of-stake network.

Fortunately, this covers thousands of cryptocurrencies. For example, Ethereum is a proof-of-stake network, meaning most ERC-20 tokens can be staked. This includes Tether, Aave, Chainlink, and Maker. Similarly, other leading networks also offer staking capabilities. This includes BNB Chain, Solana, and Avalanche.

The main exception is Bitcoin, which operates on the proof-of-work network. That said, it’s still possible to earn yields on Bitcoin – you simply need to use a third-party platform. Options include eToro, MEXC, and OKX. Ultimately, staking is considered a great option for long-term investors who want to compound their returns.

How Does Cryptocurrency Staking Work?

Staking opportunities come with varying terms and conditions but the best way to stake crypto isn’t difficult to find out. Some staking pools have a minimum holding period, while others offer flexible withdrawals. Yields are often dependent on the lock-up term. Investors should also be aware of fees, and how frequently rewards are distributed. Of late, Ethereum staking platforms have been gaining massive popularity.

Some platforms offer staking bonuses or tiered rewards based on the amount staked, encouraging larger investments. Be sure to compare platforms to maximize your returns and minimize any hidden fees. That said, let’s take a much closer look at how crypto staking works.

Proof-of-Stake Consensus

Staking rewards are offered by proof-of-stake networks like Ethereum and Solana. Investors deposit their tokens into the network, which remain locked for a certain number of days. This helps keep the network secure and stable. After the staking period is over, investors receive their coins back. This includes the principal and the staking rewards generated.

Most investors opt for off-chain staking, as the rewards are higher. This means a third-party platform is used, like a crypto exchange. This is also a more user-friendly option, as you don’t need to directly engage with the network.

What’s more, on-chain staking often comes with much higher minimums. Nonetheless, staking rewards are covered by network inflation. This is because proof-of-stake networks issue new coins when blocks are confirmed. For example, new ETH enters circulation approximately every 12 seconds.

Lock-Up Terms

Investors should understand the lock-up terms when staking cryptocurrency. This will vary depending on the staking coin and the chosen platform. For example, some staking pools offer flexible plans. This means you can withdraw your coins at any time – without financial penalty. This is like depositing funds in a traditional checking account.

However, similar to a certificate of deposit (CD), some staking pools come with a minimum lock-up term. This might be days, weeks, or a few months. Some platforms offer various lock-up periods. In many cases, longer terms come with the highest yields. However, you can’t withdraw coins while they’re locked, so do bear this in mind.

Staking APYs

Staking rewards are determined by the annual percentage yield (APY). This dictates how much you’ll earn over a 12-month period. Crucially, the staking rewards are paid in the respective cryptocurrency.

So, if you’re staking Solana, your rewards will be paid in SOL. This is ideal if you’re a long-term holder. After all, if the value of the cryptocurrency increases, your returns will be amplified. This is because the principal investment and the staking rewards benefit from price increases.

Let’s look at an example of how staking rewards work:

- Let’s say you have 10 SOL.

- At the time of the deposit, 1 SOL = $200. This means your Solana investment is worth $2,000

- You choose a staking pool that pays an APY of 10%

- After one year, you’ve earned staking rewards of 1 SOL (10% of the 10 SOL deposit)

- You unstake your coins, so you now have 11 SOL

The price of SOL has since increased to $300

- So, your original 10 SOL was worth $2,000. It’s now worth $3,000

- The 1 SOL you earned from staking rewards is worth $300

- This means your SOL portfolio is now valued at $3,000

The best crypto staking platforms make daily distributions. This means you’ll receive staking rewards daily, which can then be reinvested into the same pool. In turn, the newly earned coins will also generate staking returns. This increases the APY, as you’re compounding your investments.

Crypto Mining vs Staking

Mining and staking are two different ways to earn income from crypto.

- Mining is associated with proof-of-work blockchains, which include Bitcoin.

- It requires specialist hardware devices (like ASICs) to verify transactions.

- The first miner to solve the cryptographic problem earns the block rewards.

- Then the process starts again.

- Mining helps keep the blockchain safe, but it’s energy-intensive.

- What’s more, mining isn’t completely passive like staking. Miners must take into account maintenance and constant monitoring.

In contrast, staking offers an energy-efficient way to verify blockchain transactions. It’s also fairer and more inclusive, as everyone has a chance to earn staking rewards. This is unlike mining, as only one person can solve a block.

On-Chain & Off-Chain Staking

We will now explain the difference between on-chain and off-chain staking.

- On-Chain Staking: On-chain staking removes the middleman; you’ll be engaging directly with the blockchain network. This means your staking coins are held by the blockchain, rather than a third party. This is the safest option, as you’re removing counterparty risks. However, on-chain staking often comes with high minimum and lower APYs.

- Off-Chain Staking: Off-chain staking is the most popular option for retail investors. It enables users to stake their coins through a third-party platform. This is usually a reputable exchange like eToro or MEXC. Off-chain staking comes with small minimums and higher APYs. However, you need to trust that the platform is keeping your coins safe.

The choice between on-chain and off-chain staking is a personal one. For instance, on-chain staking comes with greater responsibilities – as you often need to become a validator. If you suffer downtime, you could be penalized. This means losing your original staking deposit. Nevertheless, on-chain staking is still considered the most secure option

If you’re looking for a hassle-free way of staking coins, off-chain platforms might be the better option. You won’t need to become a validator or meet a high minimum deposit. And, you’ll benefit from more competitive yields. However, make sure you’re using a safe staking platform. And ensure your funds are diversified across several providers.

Benefits of Staking Crypto

Recently, crypto staking has emerged as one of the most popular ways to participate in network validation to earn passive rewards. With the crypto sector continuing to evolve, staking has witnessed a spike in adoption, with crypto enthusiasts taking full advantage of the perks that come with staking. We will now discuss the core benefits of staking cryptos.

Earn Passive Income

Staking enables investors to earn passive income. Similar to savings accounts, you’ll earn a percentage of your original deposit. Without a staking pool, your coins won’t earn anything. Therefore, it makes sense to generate additional yields, rather than leave the coins in a private wallet.

For example, suppose you own $10,000 worth of Bitcoin:

- We’ll say the price of Bitcoin doesn’t move after one year

- Had you kept the Bitcoin in a private wallet, it would still be worth $10,000

- Had you deposited the Bitcoin in a Margex staking pool, you’d have earned 3%. That’s an extra $300 worth of Bitcoin.

Just remember, you’ll still benefit from price increases when staking crypto. This enables you to generate returns on two fronts; price appreciation and passive staking rewards.

Flexible Terms are Available

Flexible staking terms are available if you know where to look. For example, with the exception of Toncoin, MEXC offers flexible withdrawals on all supported staking coins.

This includes everything from Bitcoin, Ethereum, and USDT to XRP, Gala, and dYdX. As such, investors can withdraw their coins at any time. This ensures that investors can access liquidity whenever they need it.

Create a Compounding Returns

Staking enables you to create compounding returns – especially when distributions are made daily. This involves reinvesting your rewards back into the same staking pool. This means you’re earning ‘interest on the interest’.

For example:

- Suppose you’ve deposited 100 AVAX into a staking pool

- The staking pool pays 20%

- After one year, you’ve earned staking rewards of 20 AVAX, which you reinvest

- This means you’ve now got 120 AVAX

- You earn another 20% in year two

- This time, you’ve earned staking rewards of 24 AVAX

- This is because the 20% rewards are based on 120 AVAX, not the original 100 AVAX

Repeating this process over time can generate significant returns. This is the same as reinvesting stock and ETF dividends.

How to Stake Cryptocurrency

If you’re new to cryptocurrency staking, here’s a quick overview of the process:

- Step 1: Choose a Staking Platform – The first step is to choose the best staking platform. It should support your preferred cryptocurrencies, pay competitive APYs, and offer suitable withdrawal terms.

- Step 2: Deposit Staking Coins – You’ll need to deposit coins before you can begin staking. The staking platform will provide you with a unique wallet address. Copy it and transfer the coins from a private wallet. If you don’t own any staking coins, you can buy some from eToro or MEXC with a debit/credit card.

- Step 3: Choose Staking Pool – Next, choose the best staking pool for your requirements. Some platforms offer multiple lock-up terms. Make sure the terms align with your investing goals.

- Step 4: Receive Staking Rewards – Once your coins have been added to the staking pool, there’s nothing else to do. The platform will distribute the staking rewards to your account. This could be daily, bi-weekly, weekly, or monthly depending on the platform.

- Step 5: Withdraw Staking Coins – The final step is to withdraw your staking coins. You can do this at any time if you’re using a flexible staking pool. If not, you’ll need to wait for the respective staking term to pass.

To reduce the counterparty risk, consider joining several staking platforms. You can split the staking coins accordingly. For example, suppose you’ve got 10 ETH to stake. Consider depositing 2.5 ETH on four different staking sites.

Crypto Staking Taxes

In most countries, including the U.S., staking is a taxable event. It’s treated the same as other income sources, such as salaries. This means the staking rewards will be added to your total income for the year.

For example:

- Salary: $50,000

- Staking Rewards: $5,000

- Total Taxable Income: $55,000

Now for the challenging part; you’ll need to report the value of the staking rewards based on when they were received. So, if you’re receiving daily payouts, that’s up to 365 different valuations after one year.

Crypto prices change every second and can witness enhanced volatility. We would suggest using crypto tax software if you’re a long-term staker. It will automatically assign a cost basis for each staking distribution.

Is Staking Crypto Safe?

Staking crypto is a great way to earn passive income, but it’s not without risks. Just like putting money in a bank to earn interest, staking involves locking up your crypto to support a blockchain network and earn rewards. However, crypto staking isn’t always secure, and there are several risks to consider before you get started:

- Counterparty Risks: If you’re opting for off-chain staking, counterparty risks are your biggest concern. If the crypto exchange becomes insolvent, you could lose your entire staking balance. This is why we suggest using multiple staking platforms to diversify the risk.

- On-Chain Risks: On-chain staking isn’t risk-free either. For instance, on-chain validators can lose their staking deposit if they’re considered unreliable. This could simply be because the validator experienced downtime.

- Liquidity Risks: You’ll also need to consider liquidity risks. For example, when searching for the highest APY crypto staking site, you might find that minimum lock-up terms are required. No matter the circumstances, you won’t be able to withdraw the coins until the lock-up period has passed.

Market volatility is a major risk in crypto staking. Even if a token offers high rewards, a sudden price drop can erase any gains. The 2022 crypto crash demonstrated how interconnected the market is—when Terra’s stablecoin collapsed, it triggered a domino effect, bringing down major projects, exchanges, and lending platforms. Many stakers saw their holdings lose value overnight, proving that even promising projects can be vulnerable to broader market trends. Security risks are another concern. Even proof-of-stake networks can be exploited, and while staking itself may not always be directly affected, cyberattacks can disrupt blockchain operations and shake investor confidence. Hacks and exploits over the years highlight how vulnerabilities in the ecosystem can impact users, whether through lost funds or halted transactions.

Regulatory uncertainty further complicates staking. Governments worldwide are tightening their grip on crypto, with staking products also facing increasing scrutiny. In early 2023, the SEC forced Kraken to shut down its staking services in the U.S., leaving users unable to earn rewards. As regulations tighten, centralized staking platforms have faced the most challenges. Still, they are adjusting to new rules while keeping investment opportunities open.

Ultimately, all investments carry risk, so make sure you’re well-informed before staking.

Conclusion

In summary, staking is ideal for long-term crypto investors who want to generate passive returns on their holdings. Where to stake crypto is always an important question for long-term investors in the DeFi space. Our overall top pick for crypto staking platforms is eToro, which offers competitive yields on a number of cryptocurrencies, especially Ethereum and Cardano. Note, only Bitcoin, Bitcoin Cash, and Ethereum are available for U.S. customers and staking reward is not offered for US, UK/ FCA users.

Unlike other platforms, eToro enables you to stake with a very low minimum amount, $10 in this case. This means it is suitable for all pockets and investors who are just starting out, as well as veteran traders.

See Also:

- What is Liquid Staking & How Does it Work?

- Bitcoin Staking: How to Earn Rewards by Staking Crypto?

- Cardano Staking: How to Earn Rewards By Staking ADA

- Polkadot Staking: Where and How to Stake DOT in 2025

FAQs

What is Crypto Staking?

Is Crypto Staking Worth It?

What is the Best Crypto Staking Platform?

How Can I Stake Cryptocurrency?

Can You Get Rich from Staking Crypto?

What is the Best Crypto for Staking?

What is the Average Return on Crypto Staking?

What is the Minimum Amount Required to Stake?

Can I Lose my Staked Cryptocurrency?

Do I need to Pay Taxes on my Staking Reward

Which Crypto Staking Platform has the Highest APY

Are Crypto Staking Platforms Safe?

References

- Explainer: What is ‘staking,’ the cryptocurrency practice in regulators’ crosshairs? (Reuters)

- Earn rewards while securing Ethereum (Ethereum Foundation)

- What investors need to know about ‘staking,’ the passive income opportunity at the center of crypto’s latest regulation scare (CNBC)

- IRS clarifies when cryptocurrency ‘staking’ rewards are included in taxable income (BDO)

In This Article

Free Bitcoin Crash Course

- Enjoyed by over 100,000 students.

- One email a day, 7 days in a row.

- Short and educational, guaranteed!

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

Weekly Research

100k+Monthly readers

Expert contributors

2000+Crypto Projects Reviewed